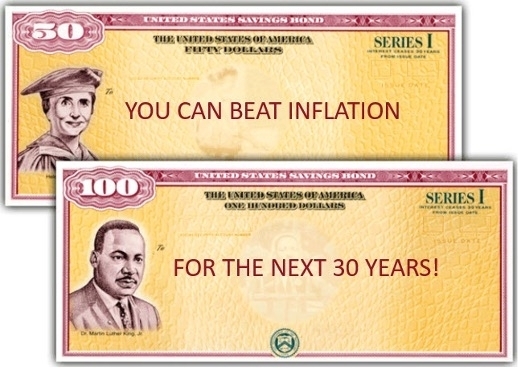

Are you looking for a savings tool or investment that will outpace inflation regardless of what the stock market and economy do? Are you looking to avoid the ups and downs of the market? Is the safety of your principal important to you? If you answered yes to any of these questions, Series I Savings Bonds may be right for you.

Series I Bonds are U. S. government savings bonds that pay a guaranteed interest rate equal to the rate of inflation and are updated every six months. I bonds currently pay the inflation-adjusted rate of 3.97% interest PLUS a fixed rate of 1.30% for a total of 5.27%. Here’s the good news, that 1.30% fixed rate will continue to be added to the inflation rate for as long as you own your bonds for up to 30 years, guaranteeing your savings will stay ahead of inflation. You must purchase your bonds before the end of April 2024 as the fixed rate on new bonds may change May 1, 2024!

Bond facts:

Learn more and purchase bonds at http://www.treasurydirect.gov.